The authorized IRS e-file provider locator service for tax professionals is a database that allows you to find different types of authorized IRS e-file providers. The database includes businesses that have been accepted into the electronic filing IRS e-file program, including for-profit providers. You can search for providers either by entering your full five-digit zip code or by selecting your state. The search results will be displayed in alphabetical order by business. It's important to note that inclusion in this database does not constitute an endorsement by the IRS, so you should still conduct your own due diligence when selecting an e-file provider. Within the locator service, there is an option to download comma-delimited text files, which contain information about each provider. These text files are grouped by state or the District of Columbia and can be imported into database software packages to create mailing lists. To opt in or out of the locator service, you need to update the authorized IRS e-file application. This can be done by accessing the IRS e-services and selecting the appropriate option on the firm information page. Thank you for watching the video. For more information and related topics, please check the description for any relevant links.

Award-winning PDF software

Efile provider services Form: What You Should Know

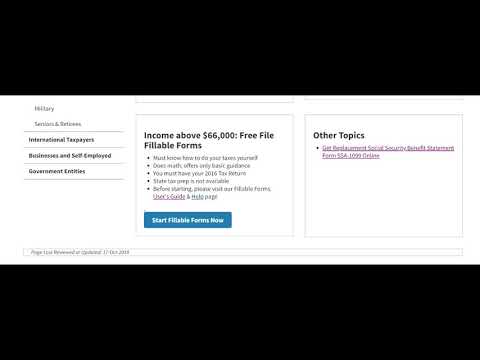

Gov webpage: 2 years ago — Use IRS.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8633, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8633 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8633 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8633 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Efile provider services