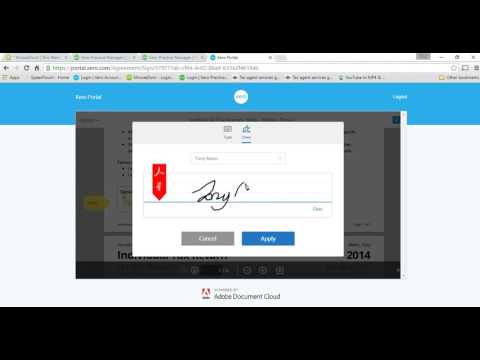

This video is going to demonstrate how to sign your tax return through zero. We're going to send tax returns to you through your email. However, we're going to get you to sign them electronically in the future. This is a very simple process that's going to eliminate a lot of paper and confusion around signing pages of tax returns. The first thing is to get this email which will be coming from us through zero. The email will simply say "document to sign". If we scroll down, there's going to be a brief description of the document and instructions on how to sign the tax return. Just scroll right down and click on "reviewed documents". When you click on "reviewed documents", it will take you to the login page of zero. Log in as normal and you'll be directed to the actual document, in this case, the 2015 tax return, for you to sign. On the left-hand side, you'll see a little arrow pointing downwards. Click on it to start signing. On the right-hand side, at the top, it will indicate the number of fields to fill out. It's quite simple. Click on "start" on the left-hand side. Then, click on "sign here". You can simply type your name or use your mouse to physically draw a signature. It doesn't matter if it's a bit messy as long as it's readable and close to your signature. Typing it in is also acceptable. After signing, click on "apply" to complete the first field. The yellow arrow will then indicate "next". Click it again to proceed to the next field. Because we saw the previous signature, it will automatically bring the same signature down. Once you have completed signing both fields, click on "sign". This will process the document and send it to yourself. You will...

Award-winning PDF software

How do you sign an e file tax return Form: What You Should Know

Read More About Electronic Signatures at eSignatures.com What is an Electronic Signature? — IRS.gov While the IRS cannot verify the electronic signature of a taxpayer through the E-file Form 8879, the electronic signature does provide verification of the taxpayer's identity when the return is filed electronically. Taxpayers filing Form 8879 are required to complete a paper form that shows their EEA tax information. The paper form must be received or mailed to the IRS by the due date for filing the Form 8879. After being received, the Form 8879 must be signed, stamped or printed by a tax practitioner or with an electronic signature for submission. The taxpayer must then sign the Form 8879 in the presence of the tax practitioner or the taxpayer's authorized representative. A certified copy of the signed Form 8879 that is received by the IRS must then be received by the taxpayer's tax return preparer before the return may be processed. A copy of the signed Form 8879 that is provided by the taxpayer to the tax practitioner or preparer in electronic format shall be accepted for filing under section 6166(a)(2) of Read More About The Electronic Signature and Paper Return Process at eSignatures.com What are the requirements for using a digital signature instead of using a paper or paperless filing method such as e-filed or electronic filing of tax returns? — eFiling.com Electronic Signatures — eFiling.com To verify that a taxpayer's electronic signature matches the taxpayer's paper signature and to prevent the possibility of double-signing, IRS E-file Pins must be used. These Pins are the taxpayers' only method to digitally authenticate the electronic signature. A holder's e-filing PIN may be any number, which may be shown or printed on IRS-issued devices or on a digital signature template that may be produced after the filing of the paper returns, whether the returns are filed electronically or submitted using the e-file or e-Filing PIN method of filing. Signature template — IRS E-file PIN Electronic Forms or Electronic Filing PIN — eFiling.com You must use an e-signature to electronically sign the tax return to the time of filing. The name of the signature template must match the name of the taxpayer. It should also have a unique electronic identifier associated with the taxpayer's return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8633, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8633 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8633 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8633 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How do you sign an e file tax return